Then, add up the cost of new inventory — this is the cost of raw materials you purchase to manufacture the product. The opportunity to achieve a lower per-item fixed cost motivates many businesses to continue expanding production up to total capacity. In fact, you already know that labor costs can spiral out of control if you don’t meticulously monitor them. A balance sheet is one of the financial statements that gives a view of the company’s financial position, while assets are the resources a company owns. These assets have value and the company can sell them to earn revenue.

Step #1: Calculate the cost of direct materials

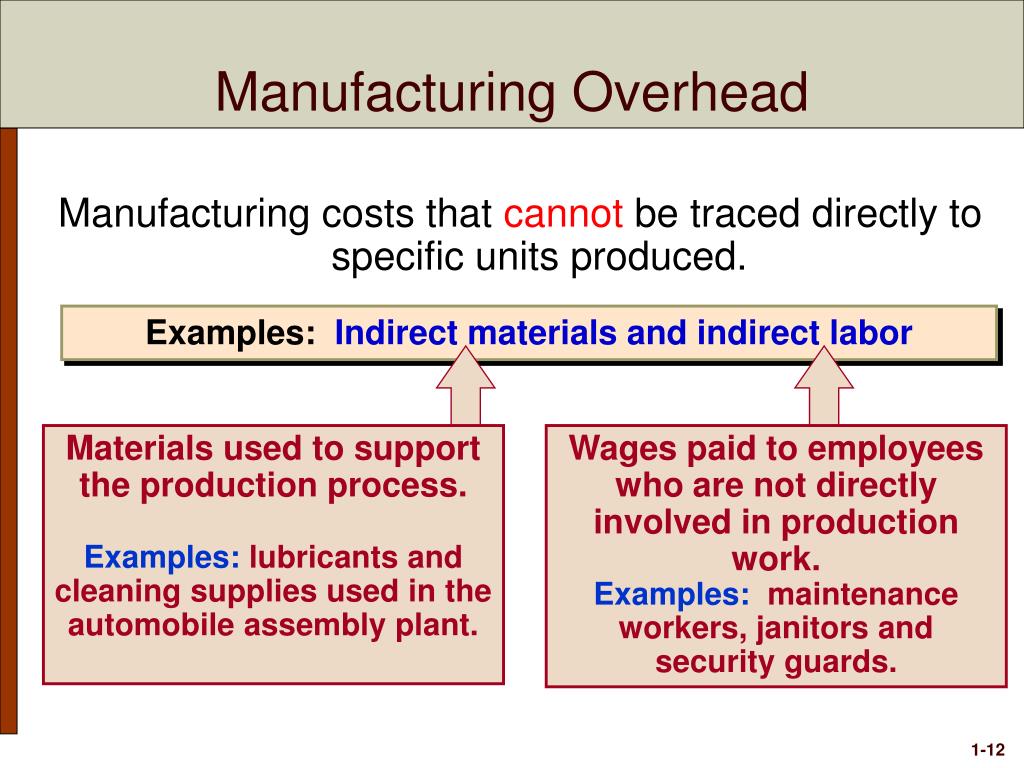

Manufacturing costs include direct materials, direct labor, and factory overhead. To help clarify which costs are included in these three categories, let’s look at a furniture company that specializes in building custom wood tables called Custom Furniture Company. Each table is unique and built to customer specifications for use in homes (coffee tables and dining room tables) and offices (boardroom and meeting room tables). The sales price of each table varies significantly, from $1,000 to more than $30,000.

What are the benefits of calculating manufacturing cost?

The relevance of costing to manufacturing companies is highly important to running an efficient and successful business. Identifying, separating and apportioning cost data provides management and outside decision makers (investors) valuable information on the company’s profitability and cost control systems. While depreciation on manufacturing equipment is considered a manufacturing cost, depreciation on the warehouse in which products are held after they are made is considered a period cost. While carrying raw materials and partially completed products is a manufacturing cost, delivering finished products from the warehouse to clients is a period expense.

How to calculate total manufacturing cost?

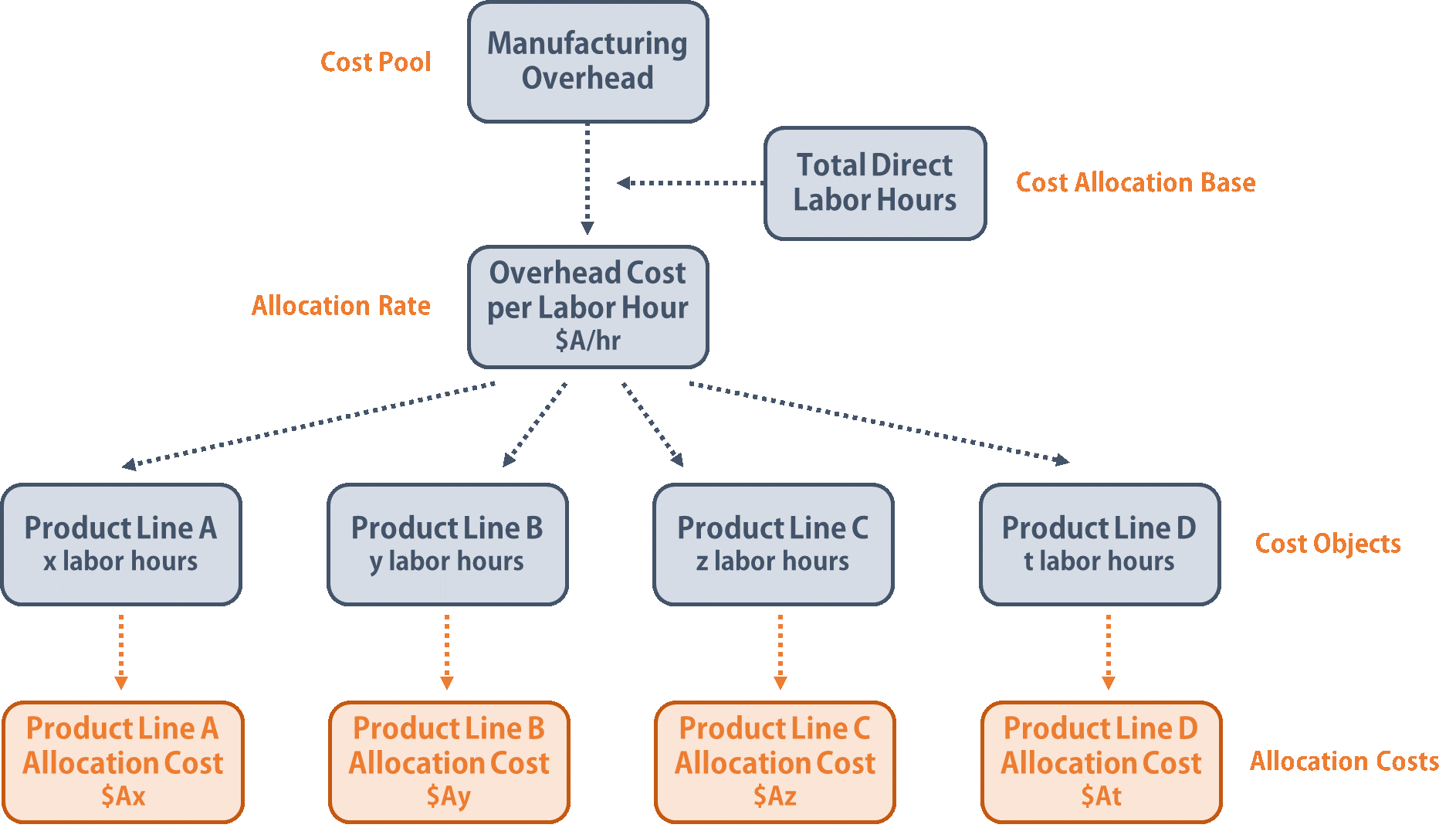

The next step is to calculate the costs of utilities (electricity, water, or gas) that are directly used in the manufacturing process (for example, fuel used to operate the production equipment). While this is a simplified view of direct labor calculation, accountants also include the benefits, overtime pay, training costs, and payroll taxes when calculating the hourly rate. Mixed costs – costs that vary in total but not in proportion to changes in activity.

Both of these figures are used to evaluate the total expenses of operating a manufacturing business. The revenue that a company generates must exceed the total expense before it achieves profitability. Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables.

Free time tracker

In the end, management should know whether each product’s selling price is adequate to cover the product’s manufacturing costs, nonmanufacturing costs, and required profit. These costs are not directly tied to the production of goods or services, but rather to the overall operation of the company. Examples professional bookkeeping certification of period costs may include rent, salaries and wages of administrative staff, office supplies, marketing and advertising expenses, and other similar expenses. While these costs are necessary for the overall functioning of the business, they do not directly contribute to the production of goods or services.

- From the table you can see that direct materials are the integral part and a significant portion of finished goods.

- As you can see, by collecting cost data and calculating it accurately, businesses can optimize cost management and set the right price for their products to gain a competitive advantage.

- Clockify is a time tracker and timesheet app that lets you track work hours across projects.

- The manufacturing dataset will inform both practical and policy work, Kane said.

- In case you’re spending too many resources on a task or project, the option to set budgets in Clockify will give you a detailed insight into how you can better balance those resources.

Nonmanufacturing overhead costs are the company’s selling, general and administrative (SG&A) expenses plus the company’s interest expense. In this example, the total production costs are $900 per month in fixed expenses plus $10 in variable expenses for each widget produced. To produce each widget, the business must purchase supplies at $10 each. After subtracting the manufacturing cost of $10, each widget makes $90 for the business.

We use the term nonmanufacturing overhead costs or nonmanufacturing costs to mean the Selling, General & Administrative (SG&A) expenses and Interest Expense. Under generally accepted accounting principles (GAAP), these expenses are not product costs. (Product costs only include direct material, direct labor, and manufacturing overhead.) Nonmanufacturing costs are reported on a company’s income statement as expenses in the accounting period in which they are incurred. Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements. As we indicated earlier, nonmanufacturing costs are also called period costs; that is because they are expensed on the income statement in the time period in which they are incurred. Nonmanufacturing costs are necessary to carry on general business operations but are not part of the physical manufacturing process.